Get More Time: Your Guide To The Tax Extension Form For 2024 Filings

Feeling a bit pressed for time as the tax deadline approaches? Many people find themselves in this spot, wishing for just a little more breathing room to get their papers in order. It is a common feeling, and you are not alone in wanting extra days to sort through everything. Perhaps you are gathering documents, or maybe life just got a bit too busy.

The good news is that the tax system offers a way to gain this extra time. It is a simple process, honestly, that lets you put off the actual filing of your main tax paperwork. This option can ease some of the pressure you might be feeling right now. It means you do not have to rush and risk making mistakes with your yearly income report.

Today, we will talk all about the tax extension form. We will look at what it is, why you might want to use one, and how to go about getting one for yourself. We will also clear up some common thoughts people have about this process, so you can feel more sure about your next steps. This information should help you feel more at ease about your tax duties.

Table of Contents

- What is a Tax Extension Form?

- Why Consider a Tax Extension?

- How to File Your Tax Extension

- Deadlines and What They Mean

- Paying Your Taxes Owed, Even With an Extension

- Avoiding Penalties the Right Way

- Can You Get a Tax Extension for Free?

- Common Questions About Tax Extensions

- Wrapping Things Up

What is a Tax Extension Form?

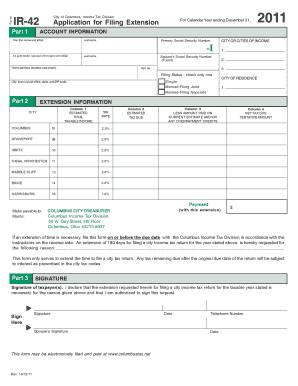

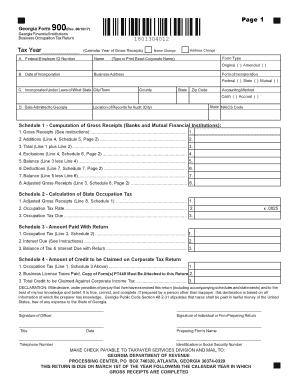

A tax extension form is basically your official request for more time to send in your yearly income tax papers. The Internal Revenue Service, or IRS, uses a specific paper for this. It is called IRS Form 4868, and it is known as the "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return." This form, in a way, gives you an automatic extra period to get your filing done. It is not something you have to beg for; it is just a standard request, as a matter of fact.

This form is for individuals who need more time to put together their federal tax reports. It is a standard document, and it is less than half a page long, which is pretty simple. When you file Form 4868, you are telling the IRS you need a few more months to get your paperwork submitted. This is for the filing itself, not for paying any money you might owe, just to be clear.

The main idea behind this tax extension form is to give people breathing room. Life can get busy, and sometimes, you just cannot get everything together by the usual due date. So, this form helps you avoid a late-filing penalty while you finish up your tax preparation. It is a helpful tool, honestly, for many taxpayers each year.

Why Consider a Tax Extension?

People consider getting a tax extension for various reasons. Sometimes, they are missing important papers like W-2s or 1099s, and they cannot complete their taxes without them. Other times, a big life event happens, like a move, a new job, or a family emergency. These things can make it really hard to focus on tax matters, you know?

Another common reason is that someone might have a complex financial situation. Maybe they have investments, or they are self-employed, and their tax situation is a bit more involved than a simple return. Figuring out all the rules and getting the numbers right can take a lot of thought and effort. So, more time helps them avoid making costly mistakes, which is a good thing.

It is also possible that you are just plain busy. Your work schedule might be demanding, or you could be caring for family members. Whatever the reason, if you feel rushed and worried about making an error, a tax extension form offers a practical solution. It gives you that extra time to prepare your return accurately, which is pretty important.

How to File Your Tax Extension

The process for filing your tax extension is quite straightforward. You will use IRS Form 4868, as we talked about. This form is the official paper for asking for an extension. You can file this request in a couple of ways: either online or by sending it through the mail. Both methods are accepted by the IRS, so you can pick what works best for you, more or less.

The most important thing to remember is that you must do this before the regular tax deadline. If you miss that date, the extension will not count, and you could face penalties for filing late. So, timing is a big part of getting this done correctly. It is a simple step, but it has to be done on time, you know?

You do not need to give a reason for why you need the extra time when you file Form 4868. It is an automatic extension. The IRS just grants it when you submit the form correctly. This makes the process much simpler than you might expect, honestly. Just fill it out and send it in.

Electronic Filing: A Quick Option

Filing your tax extension electronically is often the quickest and easiest way to get it done. You can do this through the IRS Free File website. This is a service that the IRS offers to help people with their taxes, and it includes the option to file Form 4868. It is a very convenient way to handle things, especially if you are comfortable with computers.

Many tax software programs also offer the option to file an extension electronically. If you use a tax program to prepare your regular return, you can often find the extension option right there within the software. This can save you time, as it might pre-fill some of your information. It is a pretty common feature, as a matter of fact.

When you file electronically, you usually get an immediate confirmation that your request was received. This can give you peace of mind, knowing that your extension is in place. It is a good idea to keep a record of this confirmation for your own files, just in case you ever need it. So, that is a really simple way to go about it.

Filing by Mail: The Traditional Way

If you prefer not to file online, you can always send your tax extension form through the mail. You will need to print out IRS Form 4868, fill it out completely, and then send it to the correct IRS address. The address you use depends on where you live, so you will need to check the form's instructions for that detail. This method is still perfectly fine, of course.

When mailing your form, it is a good idea to send it with proof of mailing, like certified mail with a return receipt. This way, you have a record that the IRS received your request before the deadline. It provides a little extra security, you know? This is especially helpful if you are sending it very close to the tax due date.

While mailing takes a bit longer than electronic filing, it is a reliable way to get your extension request to the IRS. Just make sure you give yourself enough time for the mail to get there before the deadline. This is a traditional method that many people still rely on, and it works just fine.

Deadlines and What They Mean

The most important thing about filing a tax extension form is doing it on time. The "My text" states this must be done "before the last day for" filing your taxes. For most people, this means April 15th, or the next business day if April 15th falls on a weekend or holiday. This is the date when your regular tax return is due, so you need to have your extension request in by then, you know?

If you file Form 4868 on time, you typically get an automatic six-month extension to submit your federal income tax return. So, if the original deadline was April 15th, your new deadline would usually be October 15th. This gives you a lot of extra time to gather all your information and prepare your return without feeling rushed, which is quite helpful.

It is very important to understand that an extension to file is not an extension to pay. This is a common misunderstanding. The deadline for paying any taxes you owe remains the same, even if you get an extension to file your paperwork. We will talk more about this next, but it is a key point to remember, honestly.

Paying Your Taxes Owed, Even With an Extension

This is a big one: "You can request an extension for free, but you still need to pay taxes owed by tax day." This sentence from the provided text is absolutely crucial. Getting an extension gives you more time to file your tax return, but it does not give you more time to pay any money you owe the government. The payment deadline stays fixed, typically April 15th for most people, as a matter of fact.

If you do not pay what you owe by the original deadline, even with an extension to file, you could face penalties. These penalties can include interest on the unpaid amount, and a penalty for not paying on time. So, it is really important to estimate how much you think you will owe and pay that amount by the original tax deadline. You do not want to be surprised later, you know?

You can make this estimated payment when you file your Form 4868. Many people do this electronically. The IRS has options for direct pay, or you can pay through your tax software. If you are not sure exactly how much you owe, try to make your best guess and pay as much as you can. Paying something is usually better than paying nothing at all, which is a good approach.

Avoiding Penalties the Right Way

Avoiding penalties is a main reason why people file a tax extension form. There are two main types of penalties you want to steer clear of: a penalty for not filing on time and a penalty for not paying on time. Filing Form 4868 on time helps you avoid the first one. It gives you that extra window to send in your paperwork without a late-filing fee, so that is a relief.

To avoid the penalty for not paying on time, you need to pay any taxes you expect to owe by the original tax deadline. Even if you cannot pay the full amount, paying as much as you can will help reduce any penalties or interest that might build up. The IRS is usually more understanding if you have made an effort to pay something, you know?

If you find yourself in a situation where you cannot pay your taxes, even after getting an extension, it is a good idea to reach out to the IRS. They have options like payment plans or offers in compromise that might help. Ignoring the problem usually makes it worse, so communication is key, as a matter of fact. Taking action, even small steps, can make a big difference.

Can You Get a Tax Extension for Free?

Yes, you absolutely can request a tax extension for free. The provided text mentions this clearly: "You can request an extension for free." The IRS provides Form 4868, and you can access it without any cost. You do not need to pay a special fee to the IRS just to ask for more time to file your return. This is a common misconception, but it is true that the request itself is free, generally speaking.

You can complete the extension request form through the IRS Free File website, as mentioned earlier. This is a completely free service. Some tax software companies might charge a small fee if you use their service just to file an extension, but the IRS's own Free File program does not. So, if you want to keep costs down, the IRS website is a good place to start, obviously.

The idea is to make it easy for people to get the time they need without adding financial burden just for the request. Remember, while the request is free, any taxes you owe are still due by the original deadline. So, it is free to ask for more time to file, but not free to delay paying your taxes, you know? That is a pretty important distinction.

Common Questions About Tax Extensions

Many people have similar questions when they think about filing a tax extension. Let us look at some of the common ones that pop up, perhaps in places like the "People Also Ask" sections on search engines. These are the kinds of things that might be on your mind, too, as a matter of fact.

What happens if I file a tax extension?

If you file a tax extension, it means you get more time to send in your tax return paperwork. For most people, this means an extra six months. So, if your taxes were due on April 15th, an extension would typically push your filing deadline to October 15th. This gives you extra breathing room to gather documents, check your numbers, and complete your return accurately. It does not, however, give you more time to pay any taxes you owe. You still need to pay your estimated taxes by the original deadline to avoid penalties. It is just a little more time to get the forms in, you know?

Can I file an extension for my taxes this tax year electronically or by mail?

Yes, you can file an extension for your taxes this tax year electronically or by mail. The provided information clearly states: "You can file an extension for your taxes this tax year electronically or by mail by submitting IRS Form 4868 with the Internal Revenue Service (IRS)." Electronic filing is often faster and provides immediate confirmation. Many tax software programs and the IRS Free File website offer this option. If you prefer, you can print out Form 4868, fill it out, and send it through the postal service. Just make sure it is postmarked by the original tax deadline. So, you have choices, which is pretty convenient.

What is IRS Form 4868 used for?

IRS Form 4868, also known as the "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return," is used by those who need more time to file their federal income tax return. The text mentions: "IRS Form 4868, also called the application for automatic extension of time to file u.s, Individual income tax return, is used by those that need more time to file their federal." It is a standard form that grants an automatic extension, usually for six months, without you needing to provide a reason. It is important to remember that this form extends the time to file, not the time to pay any taxes you might owe. You still need to pay your taxes by the original deadline, even if you get this extension to file. It is a simple document, really, that helps you avoid late-filing penalties.

What happens if I don't file an extension and file late?

If you do not file a tax extension and you send in your tax return after the deadline, you could face penalties. The IRS usually charges a penalty for filing late. This penalty is often a percentage of the unpaid taxes for each month or part of a month that the return is late. It can add up quickly, you know? So, it is usually a good idea to file an extension if you know you cannot meet the original deadline. An extension can help you avoid this specific late-filing penalty. Of course, you still need to pay any taxes you owe by the original deadline to avoid late-payment penalties as well. So, filing the extension is a protective step, basically.

Are there any downsides to filing a tax extension?

Generally, there are not many downsides to filing a tax extension, as long as you remember to pay any taxes you owe by the original deadline. The main thing to watch out for is that an extension only gives you more time to file, not more time to pay. If you do not pay your estimated taxes by the original due date, you could still face interest and penalties on the unpaid amount. Some people also find that putting off their taxes makes them more stressed later on. However, if you are organized and make your payment on time, an extension can be a very helpful tool to reduce pressure and ensure accuracy. It is really about managing your time and money wisely, you know?

Wrapping Things Up

Getting a tax extension can be a smart move if you need more time to prepare your federal income tax return. It is a straightforward process, as we have discussed, using IRS Form 4868. You can file this tax extension form electronically or by mail, and the request itself is free. Just remember that the crucial part is getting your request in before the original tax deadline, which is typically April 15th for most people. This step alone helps you avoid late-filing penalties, which is a big relief for many.

The most important takeaway, truly, is that an extension to file is not an extension to pay. You still need to pay any taxes you expect to owe by the original deadline to avoid interest and late-payment penalties. Making an estimated payment when you file your extension is a good way to stay on top of things. By understanding these key points, you can use the tax extension form to your advantage, giving yourself the necessary time to file an accurate return without unnecessary stress. It is a tool designed to help you manage your tax duties more comfortably. You can find IRS Form 4868 and its instructions directly on the IRS website.

Learn more about tax filing options on our site, and get more details about important tax deadlines.

Detail Author 👤:

- Name : Eloisa Hilpert

- Username : tstark

- Email : jamey50@hotmail.com

- Birthdate : 1997-03-24

- Address : 9201 Kaitlin View North Freida, OR 18460-7200

- Phone : +1-610-210-8849

- Company : Yost-Kuvalis

- Job : ccc

- Bio : Velit et aliquam et id consequatur reprehenderit culpa. Ullam aut qui impedit quia dolores ut neque iusto. Qui quibusdam debitis beatae ut vel error nostrum. Facere architecto expedita vel.

Socials 🌐

linkedin:

- url : https://linkedin.com/in/kaden_dev

- username : kaden_dev

- bio : Incidunt aut ipsam impedit et vel.

- followers : 1733

- following : 932

instagram:

- url : https://instagram.com/luettgenk

- username : luettgenk

- bio : Qui ab consequatur quod ut velit. Sit soluta delectus nihil ullam autem.

- followers : 840

- following : 1961

twitter:

- url : https://twitter.com/kaden.luettgen

- username : kaden.luettgen

- bio : Doloribus et hic praesentium. Consectetur facilis dolores cupiditate. Et molestias ea minus harum. Voluptas dolorem eaque repudiandae sint et eius amet fugiat.

- followers : 1546

- following : 2988

facebook:

- url : https://facebook.com/kaden_dev

- username : kaden_dev

- bio : Earum harum in repellendus nihil corrupti quibusdam. Hic autem ab quo.

- followers : 1820

- following : 1285

tiktok:

- url : https://tiktok.com/@kaden.luettgen

- username : kaden.luettgen

- bio : Omnis sunt dolore optio perspiciatis ipsam culpa et.

- followers : 2275

- following : 999