Understanding Inheritance: Your Guide To Assets, Family, And What Comes Next

Thinking about inheritance can bring up all sorts of feelings, can't it? For some, it might mean a future financial cushion, a chance to get ahead. For others, it might be about keeping family memories alive or handling unexpected responsibilities. What someone leaves behind, whether it's money, a home, or even just a few special items, really does matter quite a bit to those who receive it. It's a topic that touches many lives, and honestly, it's something most of us will think about at some point, either for ourselves or for loved ones.

You know, the idea of inheritance, it's pretty old, more or less. It goes back to when people first started passing down things like land or tools. These days, it's often about money or private property, but it can also involve things like titles, debts, or even certain rights. It's a way for someone's possessions and sometimes even their obligations to move from one person to another after they're gone, which is a pretty big deal.

So, this whole process of receiving something from someone who has passed away, it can be a bit of a puzzle. There are rules, you see, and these rules can be different depending on where you are or what the situation is. We will explore what inheritance truly means, how it works, and some of the things you might want to think about if you find yourself involved in such a situation. It's actually a fairly common part of life, and getting a clearer picture can help a lot.

Table of Contents

- What Does "Inheritance" Really Mean?

- How Things Get Passed On: The Process

- The Money Part: Taxes and Debts

- Beyond the Financial: Other Kinds of Inheritance

- Sometimes, Saying "No Thanks"

- Common Questions About Inheritance

- Preparing for What Comes Next

What Does "Inheritance" Really Mean?

When people talk about inheritance, they are usually talking about money or objects someone gives you when they pass away. This is, you know, the most common way we use the word. It could be a bank account, a house, or even a collection of old stamps. It's pretty much anything that has value that gets passed along.

More Than Just Money

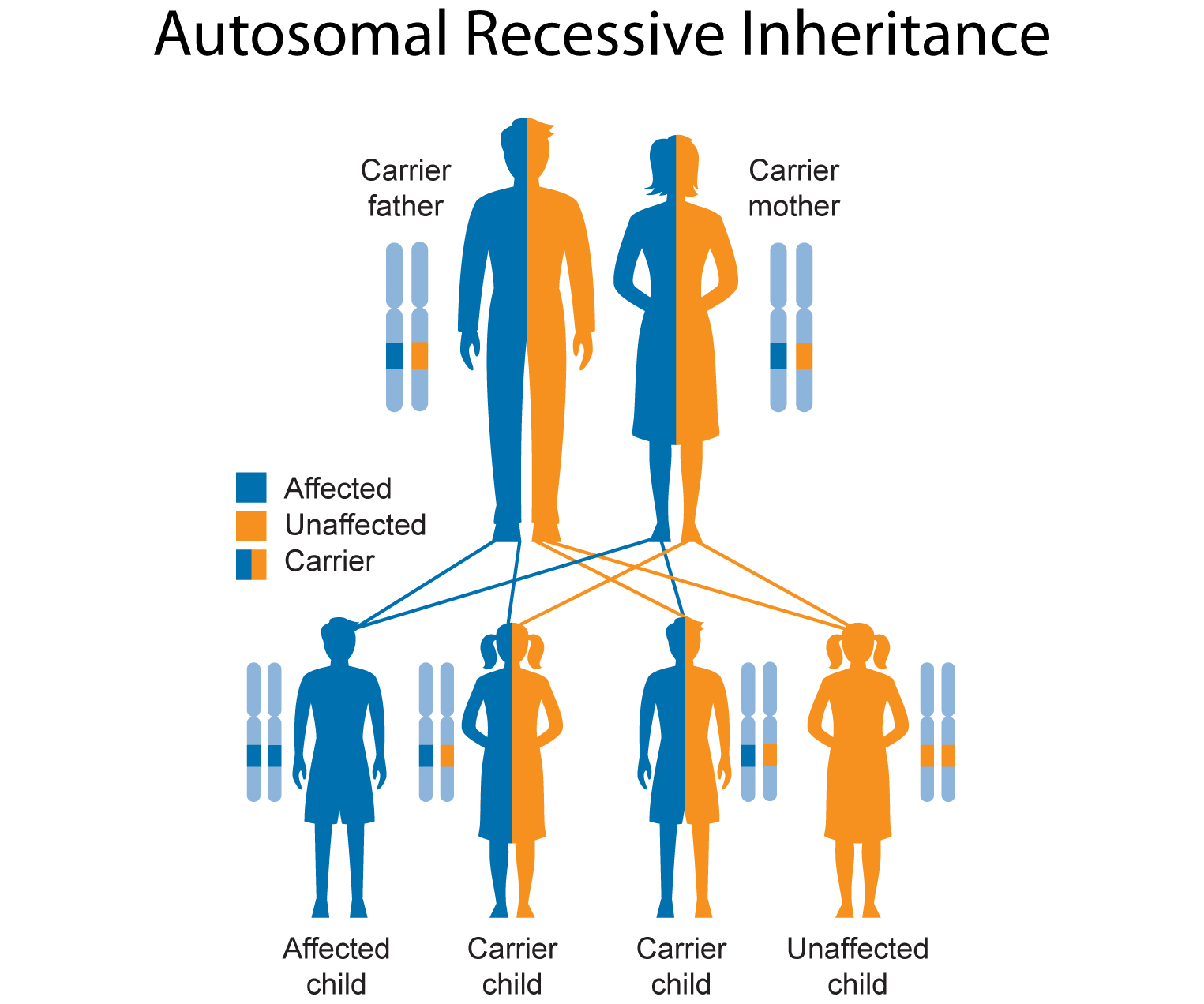

Yet, the idea of inheritance stretches a bit further than just financial stuff, actually. Think about it: we also talk about inheriting physical or mental characteristics, like someone's eye color or a certain way of thinking. It's the reception of genetic qualities by transmission from parent to offspring, which is a different, but related, idea. Sometimes, people even say they inherited a "common heritage from nature," meaning things like beautiful landscapes or ancient forests that belong to everyone. So, it's not always about things you can put in your pocket, is that right?

There's also the idea of inheriting a skill or a business, which is pretty interesting. Maybe someone starts their own business with some money or knowledge they got from a family member. That, too, can be a form of inheritance, even if it's not directly a will. It's like receiving a valuable possession that helps you get a good start, or perhaps helps you continue a family tradition. This broad view of what can be passed down shows how truly varied the concept is.

The Legal Side of Things

But for most discussions, inheritance is very much about the legal process of receiving private property, titles, debts, entitlements, privileges, rights, and obligations upon the death of an individual. This is where things can get a little formal, you know. The rules of inheritance differ among places, so what happens in one area might be quite different somewhere else. This means that if you're involved, it's pretty important to know the specific rules that apply.

An inheritance is the set of assets that an individual bequeaths to their loved ones upon their death. This might include, for instance, a large estate or a smaller collection of items. It's the action of inheriting something, or something that is to be inherited. These assets might be subject to inheritance taxes, which is a point many people wonder about. So, yes, there's a good bit of paperwork and official steps involved, typically.

A Common Human Experience

Colloquially, we use the word “inheritance” to refer to any money received from a relative who passed away. It’s a pretty common way for assets to move between generations. You may “inherit” money by being designated a beneficiary, for example, in a will or a life insurance policy. It's a deeply human experience, often tied to feelings of loss, memory, and sometimes, a fresh start. This makes it a topic that many people can relate to, in some way or another.

The concept has even inspired stories, which is pretty cool. There's a 2020 American thriller film called "Inheritance," for instance, directed by Vaughn Stein. It stars Lily Collins, Simon Pegg, and others. The story involves a patriarch of a wealthy and powerful family suddenly passing, and a young woman learning her father was once a spy, finding herself in a difficult situation. This shows how the idea of what's passed down, especially secrets or unexpected burdens, can be very dramatic, too it's almost.

How Things Get Passed On: The Process

The process of transferring assets after someone passes depends a lot on whether there is a will or if there isn't one. This is, you know, a very big distinction. Having a will makes things generally clearer, while not having one means state laws usually step in to decide who gets what. It's pretty much the foundation of how things proceed.

With a Will: Making Your Wishes Known

When someone has a will, they have put their wishes down on paper, which is really helpful. This document tells everyone who should receive what money or objects. It clearly states who the beneficiaries are, which are the loved ones who will get the assets. This makes the whole process smoother, as there's a written guide to follow, and people know what to expect. It's a way of having your voice heard, even after you're gone, so.

A will can also name an executor, which is the person responsible for making sure the wishes in the will are carried out. This person handles the assets, pays any debts, and then distributes what's left according to the will's instructions. It's a pretty important job, and it helps keep everything organized. This kind of planning can save family members a lot of trouble and disagreement later on, honestly.

Without a Will: When Rules Step In

If there isn't a will, things work a bit differently. Inheritance laws govern the rights of a decedent's heirs to inherit property. These laws, sometimes called "intestacy laws," basically decide who gets what based on family relationships. For example, a spouse or children usually come first. FindLaw explains the basic types of inheritance laws in most states, and they can vary quite a bit. This can sometimes lead to situations that the person who passed away might not have wanted, which is why having a will is often suggested.

When there's no will, a court usually appoints an administrator to handle the estate. This person does a similar job to an executor but follows the state's rules instead of the deceased person's specific wishes. It can be a longer and more complex process, actually, and it might not always result in what the family expects. So, planning ahead can really make a difference for everyone involved.

The Role of Beneficiaries

An inheritance describes the assets you’d like to leave to a loved one, who is in this case called a beneficiary. If you’d like, you can have multiple beneficiaries, which is fairly common. These beneficiaries are the people or organizations that will receive something from the estate. They could be family members, friends, or even charities. It's pretty much up to the person making the will to decide who gets what, and in what amounts.

Being named a beneficiary means you have a right to receive those assets. The process of getting those assets depends on the type of asset and the instructions in the will, or the laws if there's no will. Sometimes, it's a straightforward transfer, and other times, it involves a bit more paperwork or waiting. Knowing who the beneficiaries are is a key part of the whole inheritance process, clearly.

The Money Part: Taxes and Debts

When someone receives an inheritance, a couple of big questions often come up: what about taxes, and what about any debts the person who passed away might have had? These are pretty practical concerns, and they can affect how much a beneficiary actually gets. It's something people really need to understand, so.

What About Inheritance Taxes?

An inheritance may be subject to inheritance taxes, but this varies a lot depending on where you live. Some states have them, and some don't. Also, the relationship between the person who passed away and the beneficiary can affect whether taxes are due. For instance, a spouse might be exempt, while a distant relative might not be. Discover how inheritance works when it comes to taxes, because it's not a one-size-fits-all situation, you know.

It's important to know that inheritance taxes are different from estate taxes. Estate taxes are paid by the estate itself before assets are distributed, while inheritance taxes are paid by the person receiving the money or property. The rules can be quite detailed, and sometimes, the amounts can be significant. So, getting some information on this is usually a good idea for anyone receiving a sizable gift. You can learn more about on our site, which has some general explanations.

Handling Debts of the Deceased

Another thing to consider is the debts of the person who passed away. Generally, these debts must be paid from the estate's assets before any inheritance is distributed to beneficiaries. This means that if there are a lot of debts, the amount available for inheritance might be reduced, or in some cases, there might be nothing left. It's a pretty important step in the process, actually.

Beneficiaries are usually not personally responsible for the debts of the deceased, unless they co-signed a loan or took on the debt in some other way. However, the estate's assets are used to pay off creditors first. This is why understanding estate debts is a key part of knowing what you might receive. It's a part of the process that can sometimes be a bit surprising, to be honest.

Beyond the Financial: Other Kinds of Inheritance

While we often think of inheritance in terms of money and property, the word itself has a broader meaning, you know. It touches on things that are passed down in ways that aren't just about bank accounts or deeds. These other forms of inheritance are pretty important too, in their own way.

Family Traits and Natural Gifts

As mentioned earlier, inheritance can mean the reception of genetic qualities by transmission from parent to offspring. This is about physical or mental characteristics, like a certain laugh, a knack for numbers, or even a tendency towards a particular hair color. These are things we get from our family lines, and they shape who we are, which is pretty amazing. It's a kind of inheritance that happens naturally, without any paperwork, you know.

Then there's the idea of a valuable possession that is a common heritage from nature. This could be something like a beautiful landscape, clean air, or healthy oceans. These are things that are passed down to us by previous generations, not as personal property, but as a shared gift. We are, in a way, inheriting these natural resources, and it's our job to care for them for future generations. It's a pretty big responsibility, actually.

Skills and Starting Something New

Sometimes, inheritance isn't just about what you're given, but what you learn or are inspired to do. The text mentions "She began her own business with the." This could imply that she inherited capital, or perhaps a business idea, or even a strong work ethic from her family. It's about receiving something that helps you start something new, which is a powerful idea. This kind of inheritance can be about opportunity, really, which is quite valuable.

It's like inheriting a talent for cooking from a grandparent, or a passion for a certain craft. These aren't things that show up in a will, but they are certainly passed down and can shape a person's life in profound ways. This means inheritance can be about more than just physical assets; it's also about knowledge, skills, and inspiration, which is a pretty cool thought.

Stories and Cultural Echoes

The very idea of inheritance, as seen in the film example, can be about secrets, obligations, or even a family legacy that comes with its own set of challenges. When a young woman learns her father was once a spy, she suddenly finds herself in a situation tied to his past. This is a kind of inheritance that isn't about money, but about a narrative, a history, or a set of circumstances that are passed down. It's a pretty compelling idea, honestly.

Similarly, cultures pass down traditions, stories, and values from one generation to the next. These are intangible inheritances, but they shape communities and individuals just as much as financial assets do. They give us a sense of belonging and a connection to the past. So, the idea of what we inherit is actually very broad, encompassing many different aspects of life and human experience.

Sometimes, Saying "No Thanks"

An inheritance often is seen as a financial windfall, something everyone would want. But, you know, there are times when people may want to consider saying thanks, but no thanks. Receiving a sizable gift, if not handled carefully, can sometimes come with unexpected burdens. This might seem strange to some, but it does happen, actually.

Why Someone Might Decline a Gift

There are a few reasons why someone might choose to refuse an inheritance. For instance, if the inheritance comes with a lot of debt, and the debts are more than the assets, a person might not want to take it on. It could also be that accepting the inheritance would affect their own financial situation in a negative way, perhaps by making them ineligible for certain benefits. Or, you know, there might be family reasons, like wanting to avoid conflict or simply not needing the money. It's a personal choice, and it happens more often than you might think.

Refusing an inheritance usually involves a legal process, where the person formally disclaims their right to the assets. This means they are essentially saying they don't want it, and the assets would then typically pass to the next person in line according to the will or state law. It's a decision that usually needs careful thought, and sometimes, getting advice from a legal professional can be really helpful. You can find more information about this on this page.

Common Questions About Inheritance

People often have a lot of questions about inheritance, which is perfectly natural. Here are a few common ones, the kind you might see in a "People Also Ask" section, that might help clear things up a bit. These are pretty common concerns for many folks.

How does inheritance work when there is no will?

When someone passes away without a will, their assets are distributed according to state laws, which is sometimes called "intestacy." These laws basically lay out who gets what based on family relationships. Typically, a spouse and children are first in line, then parents, siblings, and so on. The court will appoint someone to manage the estate, and that person will follow these legal rules to distribute everything. It can be a longer process than if there were a will, and the outcomes might not always be what the deceased person would have wanted, which is something to keep in mind, too it's almost.

Are inheritance gifts taxed?

Whether an inheritance is taxed really depends on where you live and the amount involved. Some states have inheritance taxes, which are paid by the person receiving the assets. Other states do not. There are also federal estate taxes, which are paid by the estate itself before anything is distributed, but these usually only apply to very large estates.

Detail Author 👤:

- Name : Carol Bergnaum

- Username : tess35

- Email : gmaggio@effertz.net

- Birthdate : 1982-08-21

- Address : 5657 Mayer Mission East Annalise, NM 70821

- Phone : 1-607-321-0478

- Company : Jenkins-Torp

- Job : Educational Counselor OR Vocationall Counselor

- Bio : Quia asperiores perspiciatis consectetur dolorem occaecati est. Fugiat cumque exercitationem doloremque non odit vero. Quos atque fugit et. Voluptatum minima qui minus quod in dolorum.

Socials 🌐

tiktok:

- url : https://tiktok.com/@o'keefej

- username : o'keefej

- bio : Modi molestiae nobis qui commodi rerum optio.

- followers : 4111

- following : 2701

linkedin:

- url : https://linkedin.com/in/jasmin6117

- username : jasmin6117

- bio : Sed vel facere mollitia ab.

- followers : 3287

- following : 1933

facebook:

- url : https://facebook.com/o'keefej

- username : o'keefej

- bio : Odio cumque ex aspernatur ratione. Et doloremque voluptas at.

- followers : 5255

- following : 1116